Weekend Feature: Understanding Free Healthcare (AKA Single-Payer)

You Can Live and Work in Denmark or Cincinnati, Ohio — Which Offers the Better Life? [Original Post April 2025]

Music for this morning’s reading on YouTube.

I wanted this to be free for everyone, but

I thought about it. If you are a paid subscriber and you have this information, your life will change in two ways.

First, you will be able to own every debate and conversation about free healthcare. Regardless of your beliefs, being able to dominate people who are single-issue-broken-record-party-wreckers politely can really improve social settings :).

Second, you will have a framework to compare relocation decisions. This is the most important of the two. When you move, you need to make an informed move. Often, the people who are involved in recruitment do not have the knowledge you need. You need to know about the cost of living, the power your money has, and what kind of chaos mitigation is available if needed.

If You Were Wondering, Here are the Main Types of Healthcare:

Single-Payer Healthcare

Think: “One big government insurance plan for everyone.”

The government pays for most or all healthcare costs, using taxes. You still go to the doctor or hospital like usual, but you don’t get a big bill afterward.

🇨🇦 Example: Canada

“You go to the doctor, show your health card, and that’s it—no bill. Also, no private options. You take what they have. You wait however long you need to wait.”

Private Healthcare

Think: “You’re on your own to buy insurance or pay the doctor.”

People buy insurance from companies, or they pay out of pocket. What you get and how much you pay depend on your plan.

🇺🇸 Example: United States

“You pick your insurance plan, pay premiums, and still might get bills later.”

Mixed Healthcare

Think: “Everyone gets basic coverage, and you can pay extra if you want more.”

The government provides a public health plan that covers most care, but private insurance or services are available for faster access or special treatment.

🇯🇵🇰🇷 Example: Japan and South Korea

“The government helps pay for care, but if you want a fancy hospital room or quicker surgery, you can pay more.”

In this post, we are going to compare life expectancy to healthcare systems. We are also going to financially model living in the USA and Denmark to see what works for most people long term.

Note on the research method I used:

I have lived in five countries and had medical procedures in each

I have family in Canada and the USA; I have to deal with medical issues in both countries and multiple US States

I have researched not only living, but moving somewhere just for medical care, for friends, and family

I took my experience and used it to begin the filtering of data

I used ChatGPT Pro, Grok 3 (Paid, not Free) to create tables and lists

I had each AI review the others’ data; AI vs AI is very useful, but you need to pay for services to have any decent results

I took 30% of the results and looked them up on horrible government websites to confirm they were within range

I also use tax calculators that are available for relocation decision-making

I took known values and consistently ensured the AI knew them, assuming those published values are correct

I did not list communist countries because their systems are a blackhole; I can tell you that in Vietnam, my tour guide said, “That’s a government hospital. Never go there.”

The Countries We Can Call Single-Payer, Universal Healthcare Countries

I am being generous. If they are mostly single-payer, they are on the list:

Canada – Each province runs public insurance; private only for extras

United Kingdom – The NHS directly delivers care, fully public for most services

Taiwan – Centralized, smart-card-based NHI; no opt-out, single payer

South Korea – Became single-payer in 2004; delivery is mostly private but tightly regulated

Norway – Publicly funded and delivered; universal access

Sweden – County-funded system, taxes pay for nearly all core care

Denmark – Regionally run, tax-funded, minimal out-of-pocket

Iceland – Centralized public funding; small private sector

Finland – Municipality-based but nationally supported; the public is the primary payer

Italy – Servizio Sanitario Nazionale covers all, private for queues/extras

Spain – SNS is tax-funded, universal, and core care is all public

Portugal – SNS provides public care, tax-funded, and private care is optional

Life Expectancy

Here is a list of countries with the most recent data for the highest life expectancy:

Hong Kong SAR – Life expectancy: 85.8 years – Mixed system: Universal public care (Hospital Authority) + robust private sector (~50% use)

Japan – Life expectancy: 85.0 years – Mixed system: Universal public insurance (SHI) with mandatory private co-pays (~30%) and private options

Switzerland – Life expectancy: 84.3 years – Mostly private: Mandatory private insurance, heavily regulated, with subsidies for low-income residents

Singapore – Life expectancy: 84.3 years – Mixed system: Public hospitals + mandatory savings (Medisave) and optional private insurance

Australia – Life expectancy: 83.9 years – Mixed system: Single-payer public (Medicare) + significant private insurance (~50% have coverage)

Hmm. That’s weird.

All joking aside, this is meaningless for most people working overseas. However, I did think that it was interesting and, reflecting on my travels, these places generally have healthy and active people.

And here is the Single-Payer life expectancy with three points of data. You can see it is generally improving over time:

Canada – Life expectancy: 76.3 (1980s), 78.4 (1990s), 82.5 (2025) – Provincial public insurance

United Kingdom – Life expectancy: 74.0 (1980s), 76.0 (1990s), 81.3 (2025) – NHS fully public

Taiwan – Life expectancy: 72.1 (1980s), 74.5 (1990s), 81.5 (2025) – Centralized NHI, single-payer

South Korea – Life expectancy: 65.9 (1980s), 72.4 (1990s), 83.7 (2025) – Single-payer since 2004

Norway – Life expectancy: 76.0 (1980s), 77.8 (1990s), 83.3 (2025) – Publicly funded and delivered

Sweden – Life expectancy: 76.5 (1980s), 78.8 (1990s), 83.2 (2025) – County-funded, tax-based

Denmark – Life expectancy: 74.6 (1980s), 76.0 (1990s), 81.9 (2025) – Regionally run, tax-funded

Iceland – Life expectancy: 77.0 (1980s), 79.0 (1990s), 83.2 (2025) – Centralized public funding

Finland – Life expectancy: 74.0 (1980s), 76.6 (1990s), 82.0 (2025) – Municipality-based, public payer

Italy – Life expectancy: 74.5 (1980s), 77.5 (1990s), 84.2 (2025) – SSN universal, private extras

Spain – Life expectancy: 75.0 (1980s), 77.5 (1990s), 83.2 (2025) – SNS tax-funded, universal

Portugal – Life expectancy: 71.5 (1980s), 74.5 (1990s), 82.1 (2025) – SNS public, private, optional

Food and environment are also important, I shared this because it is interesting, not definitive.

Social Media Says We All Need to Live in Denmark

Every week, someone online says that Denmark is the best place to live, and they have great healthcare. I had a Danish exchange student in High School, as long as he is there, I will not be using the Danish healthcare.

Specifically, last week, someone was talking about how living in Greenland would be better than the USA. Because? If the USA bought Greenland, the people would suffer because of healthcare.

I have researched Greenland many times. It is a tough place to live. They have huge issues with healthcare, specifically getting doctors, supplies, etc. Maybe because it is freezing cold and far away from the healthcare mothership. Denmark is probably spending many times more per Greenlander to get them what they have. It is a monumental task.

If multiple companies invested in Greenland by creating jobs and offering private healthcare, it would immediately boost local resources and economic activity. While long-term transformation might take decades, the short-term impact would be noticeable.

Healthcare quality would naturally rise—companies need healthy workers to stay productive. Given Greenland's harsh working conditions, maintaining a strong workforce would require more than just emergency care. Preventive care would become essential to sustaining and expanding workforce capacity. The connection is simple: better health leads to better labor outcomes.

Maybe that short-term boost in health and money would allow people to save and eventually move into a better life somewhere. No one on social media will discuss that. Denmark GOOD! Not-Demark BAD! :)

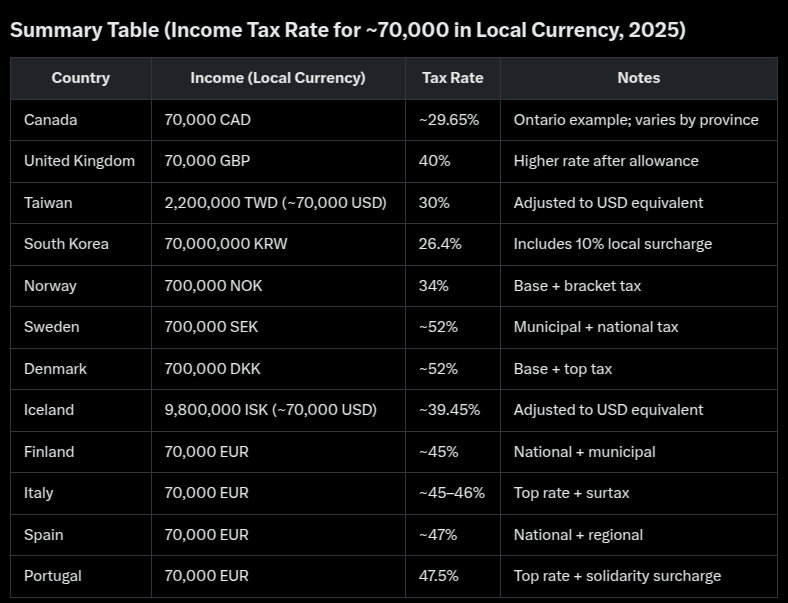

Let’s look at Money and Single-Payer Countries:

All tables use a value of $70,000.00 USD converted to local currency.

What we see here is that with the tax requirements to support Single-Payer services, you have a tradeoff. That tradeoff is how much your money is worth, or how much you can buy over time. Wage growth is also fairly stagnant. Taxes have stayed fairly stagnant, or dropped a bit, in most of these places. They have taxes, but stable taxes. That is excellent for planning long-term.

Cincinnati and Denmark

I lived in Cincinnati for a long time. I knew how much things cost back in the 90s. I use it as a baseline for the USA. When I want to know if a place is going to be economically sustainable for relocation, I compare the cost of living to Cincinnati, Ohio.

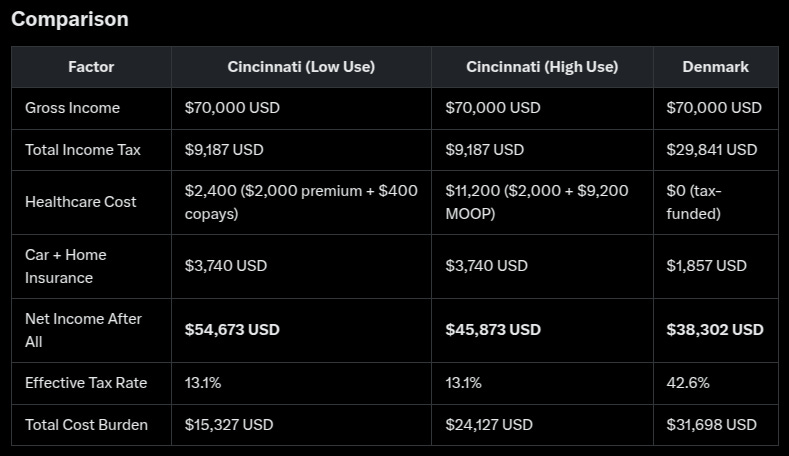

The question I asked for this newsletter: Is it financially better to live in Cincinnati or Denmark? That included an assumption that I would need to pay for and use healthcare in the USA. I also did not include the benefits Americans receive as they get older. America has some Single-Payer programs.

Analysis with U.S. Maximum Out-of-Pocket (MOOP) Rules:

Think: “A safety net for your wallet.”

In 2025, the most you’ll have to pay for in-network care (like doctor visits and hospital stays) is $9,200 if your health plan follows the rules. After that, insurance covers everything 100% for the rest of the year. (My private plan is lower at $6200.00).

Two Scenarios:

Low Use:

If you only spend $400 all year in copays, you’re nowhere near the $9,200 cap—so it’s not something you’ll need to worry about.High Use:

If you have surgery, a long hospital stay, or need a lot of care and hit the $9,200, then you’re protected. No more out-of-pocket costs after that—huge relief in a medical crisis.

Financially, Cincinnati is better. Low use yields $54,673 (43% more than Denmark’s $38,302), and high use yields $45,873 (20% more), thanks to lower taxes and the MOOP cap. The $40 copay plan keeps costs predictable unless you hit $9,200, still leaving you ahead.

Healthcare Security: Denmark wins. Free care removes all out-of-pocket risk, ideal if you value certainty or anticipate high medical needs not fully covered in the U.S. (e.g., out-of-network, non-EHBs).

Your Choice: If maximizing disposable income matters most and you’re comfortable with $400–$9,200 in potential healthcare costs, Cincinnati is preferable. If avoiding healthcare expenses entirely and accepting lower net income aligns with your priorities, Denmark is better.

What’s Missing? Employer Healthcare Plans Vary in the USA

In many instances, private insurance in the USA rivals Single-Payer in places like Denmark, Canada, and the UK.

As an example, my current family plan is about 8% of my income. It has an MOOP of $13,000.00 for all five of us. In my opinion, it is very high compared to past plans I have had. But, when we had children, it was very affordable, flat fee, fast diagnostics, and no extra cost for unplanned emergencies. We had more check-ins, ultrasounds, etc than we could have received in Canada.

Personal story over.

Aside from having choices, you also have speed and a wide variety of diagnostics. Being asked to wait four months (recently happened to a family member) for a cancer screening is very troubling.

Examples of U.S. Employer-Provided Healthcare Rivaling Denmark:

Google (Alphabet Inc.)

Coverage: Medical, dental, vision, mental health, fertility, and on-site clinics.

Employee Cost: Little to no premiums; copays ~$20–$30; MOOP < $2,000/year.

Rivalry to Denmark: Fast access, broad benefits, high satisfaction scores.

Limitation: Only for Google employees, not universal.

Microsoft

Coverage: Full medical, dental, vision, mental health (via Lyra), HSA with $1,000–$2,000 contributions.

Employee Cost: $50–$100/month premiums; copays ~$20–$40; MOOP ~$3,000–$4,000.

Rivalry to Denmark: On-site and telehealth care mirrors accessibility; global support.

Limitation: Coverage ends with employment.

Starbucks

Coverage: Health plan for part- and full-time staff; includes mental health and emergency fund.

Employee Cost: $20–$40/month premiums; $25 copays; MOOP ~$5,000–$6,000.

Rivalry to Denmark: Inclusive eligibility, solid mental health, and chronic care.

Limitation: MOOP is higher than in Denmark; less ideal for frequent users.

Walmart

Coverage: Medical, dental, vision, telehealth, and top-tier surgery centers (e.g., Mayo Clinic).

Employee Cost: $30–$50/month premiums; $35 copays; MOOP ~$6,000–$7,000.

Rivalry to Denmark: Affordable for low-wage workers; broad network.

Limitation: Quality and costs vary; not as low-barrier as Denmark.

Boeing

Coverage: Medical, dental, vision, wellness programs; strong chronic care support.

Employee Cost: $50–$100/month premiums; $20–$40 copays; MOOP ~$4,000–$5,000.

Rivalry with Denmark: Preventive focus and low costs reflect Denmark’s system.

Limitation: Still employment-based; higher MOOP than Denmark’s $0.

Overall, companies like Google, Microsoft, Starbucks, Walmart, and Boeing offer employer-provided healthcare that rivals Denmark’s in coverage, cost, and quality for their employees, often surpassing it in speed and extras (e.g., dental). However, Denmark’s universal, no-cost-at-point-of-use system remains unmatched in scope and security. If you’re employed by one of these U.S. giants, your healthcare could rival or exceed Denmark’s experience—until you leave the job.

Wait! So What’s the Answer?

The answer is tradeoffs. This is what politicians and ravenous single-issue party wreckers never talk about. Every choice is a tradeoff.

If you want to grow your money, work on staying healthy, build for retirement, and improve your life, you likely need to be in a place like Cincinnati, Ohio. It offers more flexibility, higher wage growth, and lower tax liability. You will be able to buy a home and ensure that most of the chaos that life brings is manageable. Staying healthy normally requires being active and connecting with a community. Having a support community normally has benefits to health and savings.

If you are worried about your health, have a chronic condition, or are more concerned with sustaining your level, then moving somewhere like Denmark reduces chaos, decision making, and adds stability.

Or, you can go for balance and take the good with the bad and avoid extremes.

Some of the Sources Used by Me and AI for this Post

Expatistan

Numbeo

Nerd Wallet

Relocate Me (https://relocate.me)

OECD.Stat for historical wage growth and inflation (e.g., Canada, UK, Nordic countries) up to 2023.

IMF World Economic Outlook (2023/2024) for inflation forecasts and trends.

Statistics Canada for Canadian wage and inflation data.

Office for National Statistics (UK) for UK wages and inflation.

Statistics Korea (KOSTAT) for South Korea wage trends.

Statistics agencies in Norway, Sweden, Denmark, Iceland, and Finland for Nordic data.

ISTAT (Italy), INE (Spain, Portugal) for Southern Europe data.

World Bank’s World Development Indicators for global wage and inflation trends.

OECD Tax Database for historical/current tax rates (e.g., Canada, UK, Nordic countries) up to 2024.

PwC Worldwide Tax Summaries for tax changes (e.g., Taiwan, South Korea) up to 2024.

Tax Foundation for U.S. federal/state tax data and international comparisons.

Canada Revenue Agency (CRA) for federal/provincial tax rates.

HM Revenue & Customs (UK) for UK tax data.

Danish Tax Agency (SKAT) for the Danish tax structure.

Italian Revenue Agency for SSN funding in Italy.

IRS for 2024 U.S. tax brackets and deductions, projected to 2025.

WHO Global Health Observatory for system descriptions and per-capita healthcare spending.

Commonwealth Fund for international health system profiles.

Kaiser Family Foundation (KFF) for U.S. employer insurance costs and MOOP limits.

Centers for Medicare & Medicaid Services (CMS) for Medicare/Medicaid details.

Health Canada for the Canadian Medicare funding structure.

Danish Health Authority for Denmark’s healthcare model.

Company reports (Google, Microsoft, Starbucks, Walmart, Boeing) for U.S. employer plan details.

WHO Global Health Observatory for life expectancy (1980s–2023).

UN Population Division’s World Population Prospects for life expectancy data.

World Bank’s indicators for historical life expectancy trends.

Statistics Canada for Canadian life expectancy.

ONS for UK life expectancy.

KOSTAT for South Korean life expectancy.

Statistics agencies in Norway, Sweden, Denmark, Iceland, and Finland for Nordic life expectancy.

ISTAT (Italy), INE (Spain, Portugal) for Southern Europe life expectancy.

Australian Bureau of Statistics for Australian life expectancy.

Hong Kong Census and Statistics Department for Hong Kong's life expectancy.

CIA World Factbook for country profiles (e.g., GDP, healthcare spending).

Eurostat for EU country tax/life expectancy data.

U.S. Census Bureau for Cincinnati/Ohio insurance cost context.

Bureau of Labor Statistics (BLS) for U.S. wage and employer insurance trends.

Insurance industry reports (e.g., Insure.com, ValuePenguin) for Cincinnati car/home insurance.

Corporate websites/press releases (Google, Microsoft, Starbucks, Walmart, Boeing) for 2023–2024 health plan details.

Specific figures (e.g., Canada’s 82.4 years in 2023) were directly pulled and adjusted for 2025.

Broader trends (e.g., OECD averages) are used when 2025 data is unavailable.

Projections for 2025 extended from 2023–2024 patterns (e.g., IMF).

Multiple sources blended to ensure accuracy (e.g., WHO + UN life expectancy).